Financial Models

Chestnut Ridge Consulting Services [CRCS] provides expert, Excel-based real estate financial models for multifamily, mixed-use, hotel, condo, and land development projects. Our models deliver detailed underwriting, cash flow projections, IRR waterfalls, and sensitivity analyses—built to support developers, investors, and family offices nationwide. CRCS also specializes in integrating and syncing project accounting actuals directly into each model, creating a seamless link between forecasted performance and real-time financial data for more accurate tracking, reporting, and decision-making.

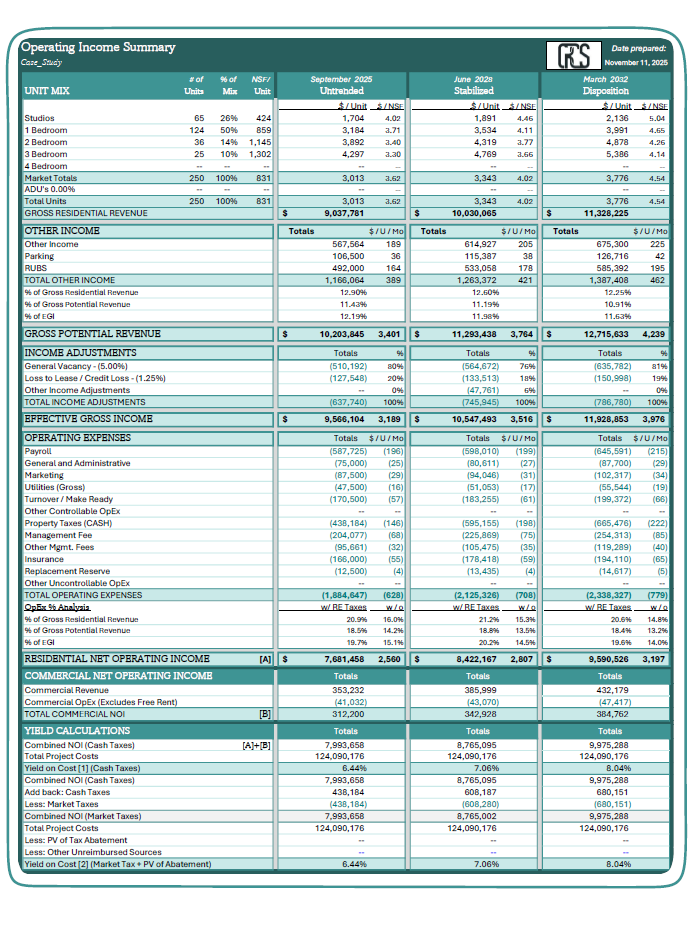

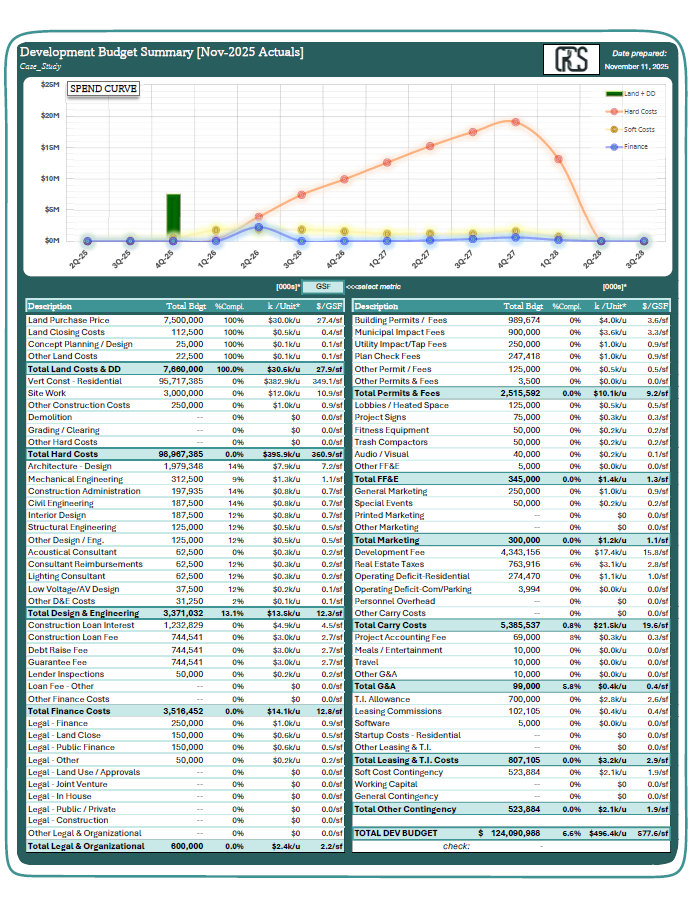

Multifamily / Mixed Use Development Model

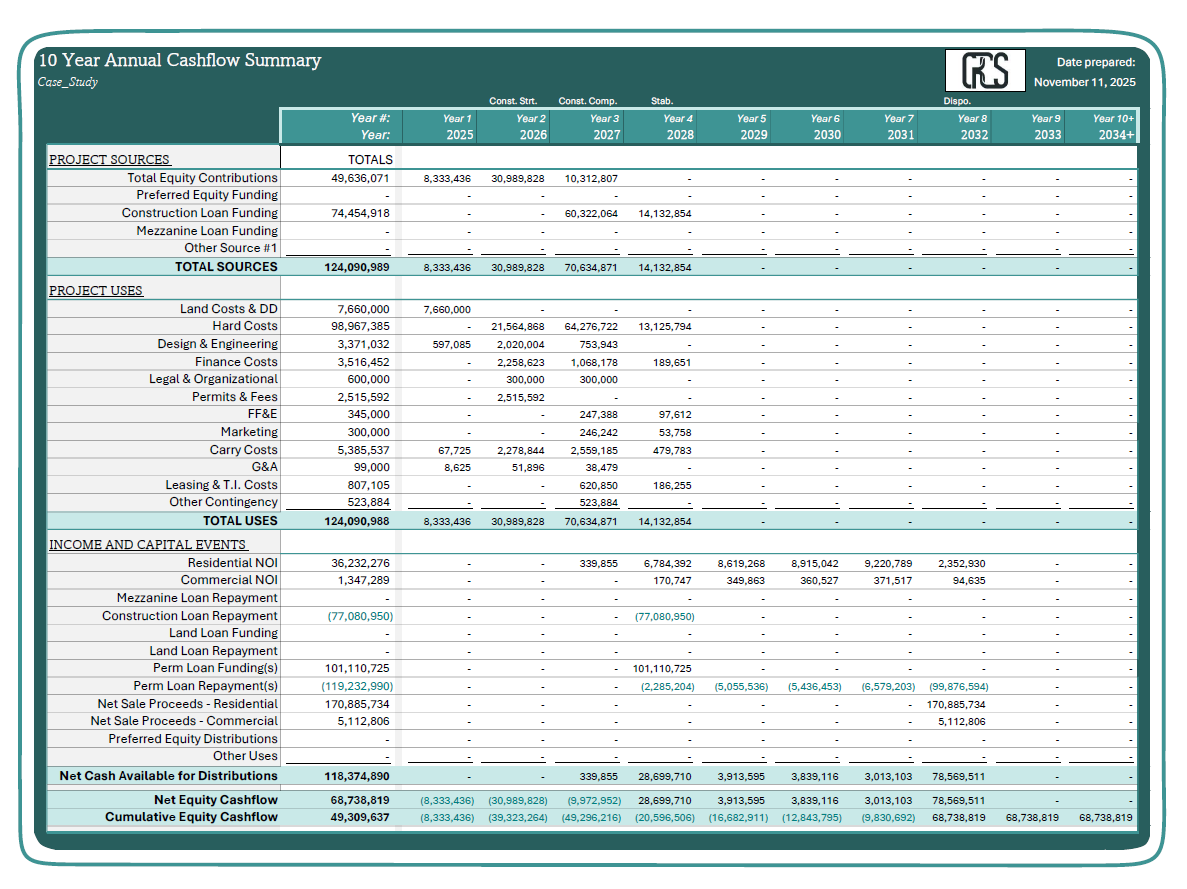

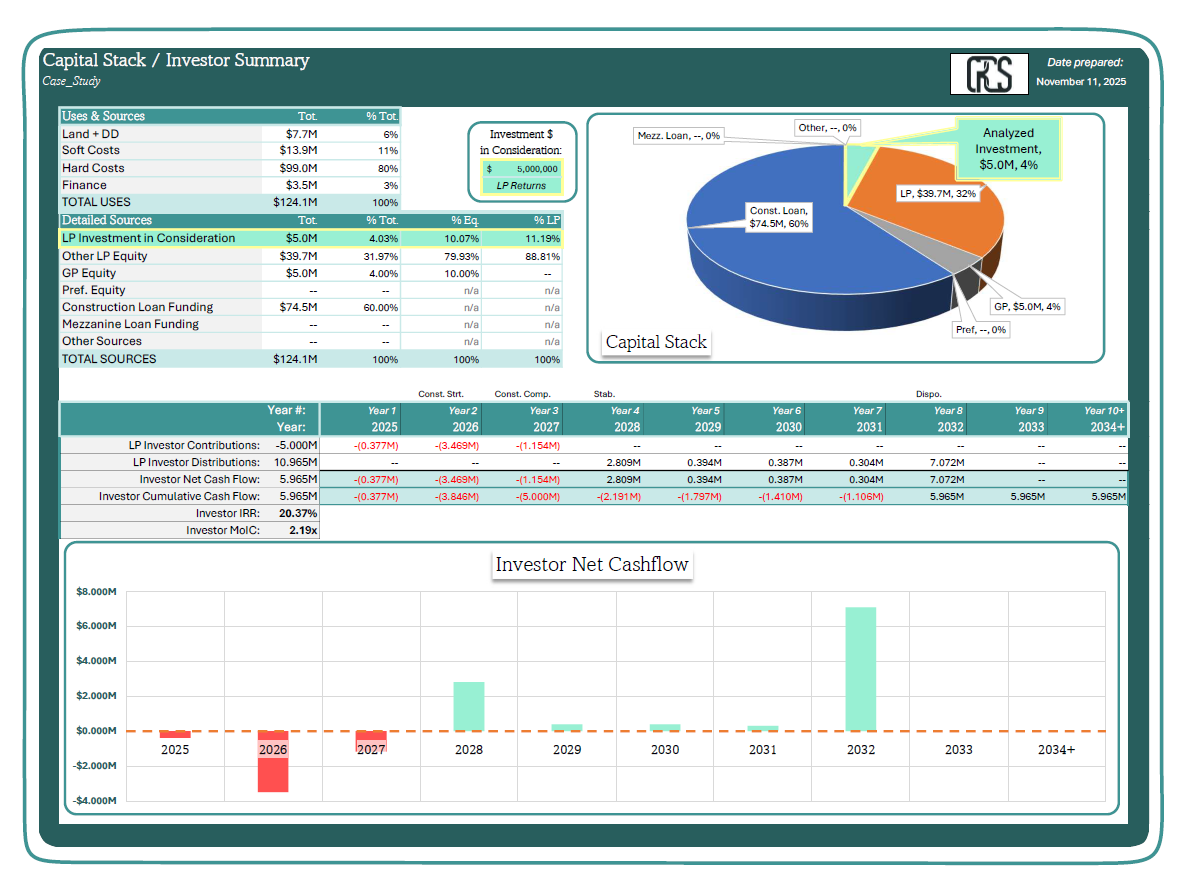

Our Multifamily & Mixed-Use Development Financial Model provides a complete Excel-based framework for underwriting complex real-estate projects. The model captures every layer of a deal—from market-rate and affordable units to tax abatements and federal or state historic tax credits—with transparent waterfall visibility and dynamic financing options including construction, permanent, mezzanine, land loans, and preferred equity. Built for clarity and flexibility, it supports customizable cost curves, detailed commercial underwriting, and comprehensive disposition analysis to help developers and investors evaluate returns with confidence.

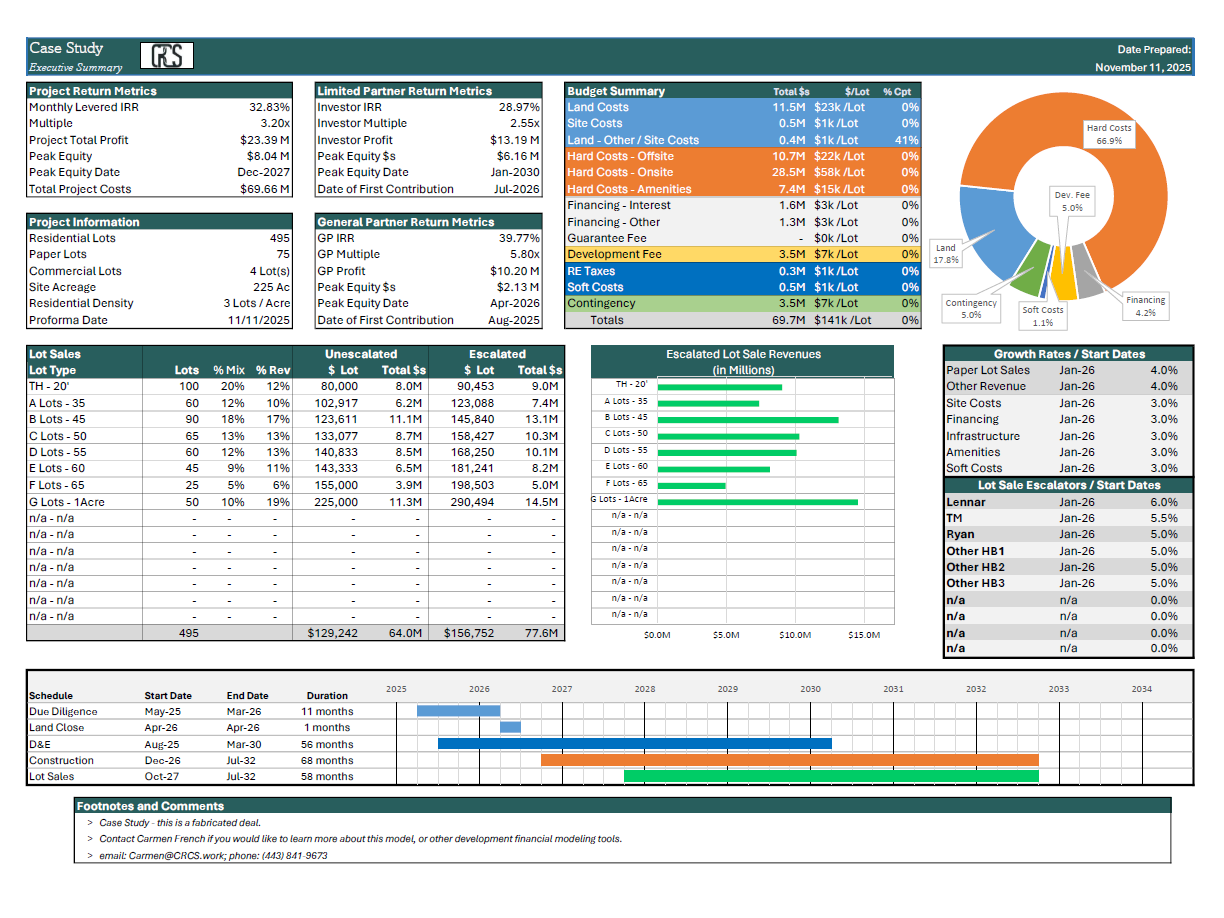

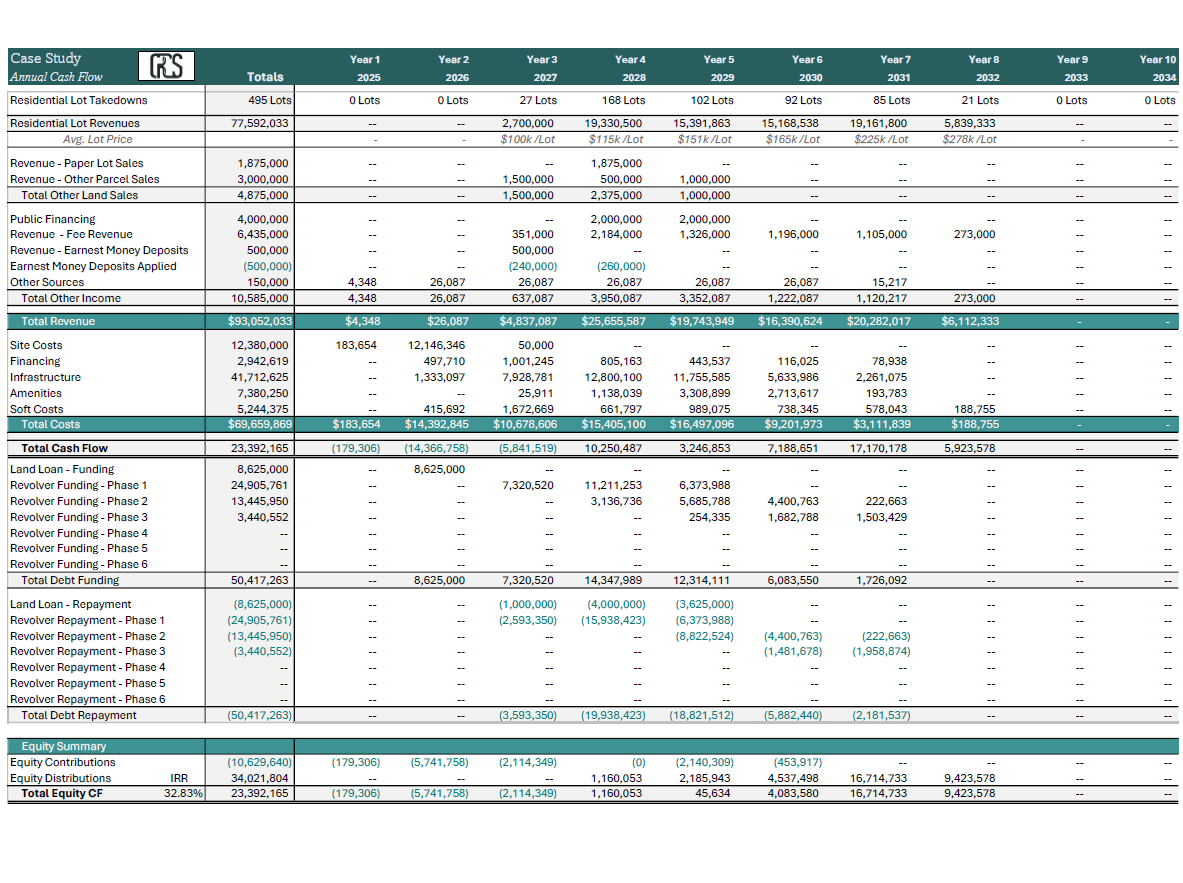

Land Development Model

Our Land Development Financial Model delivers a powerful, Excel-based platform for analyzing multi-phase residential and mixed-use projects. Model up to six development phases with phase-specific budgets, cash flows, and financing structures. Evaluate performance across up to ten homebuilders with customizable revenue escalators and fifteen unique lot types. The model supports paper lot and parcel sales, integrates public-financing tools for infrastructure and reimbursements, and tracks contingencies and capital exposure in detail—giving developers, lenders, and investors complete visibility from raw land through final lot sales.